Insurance Articles

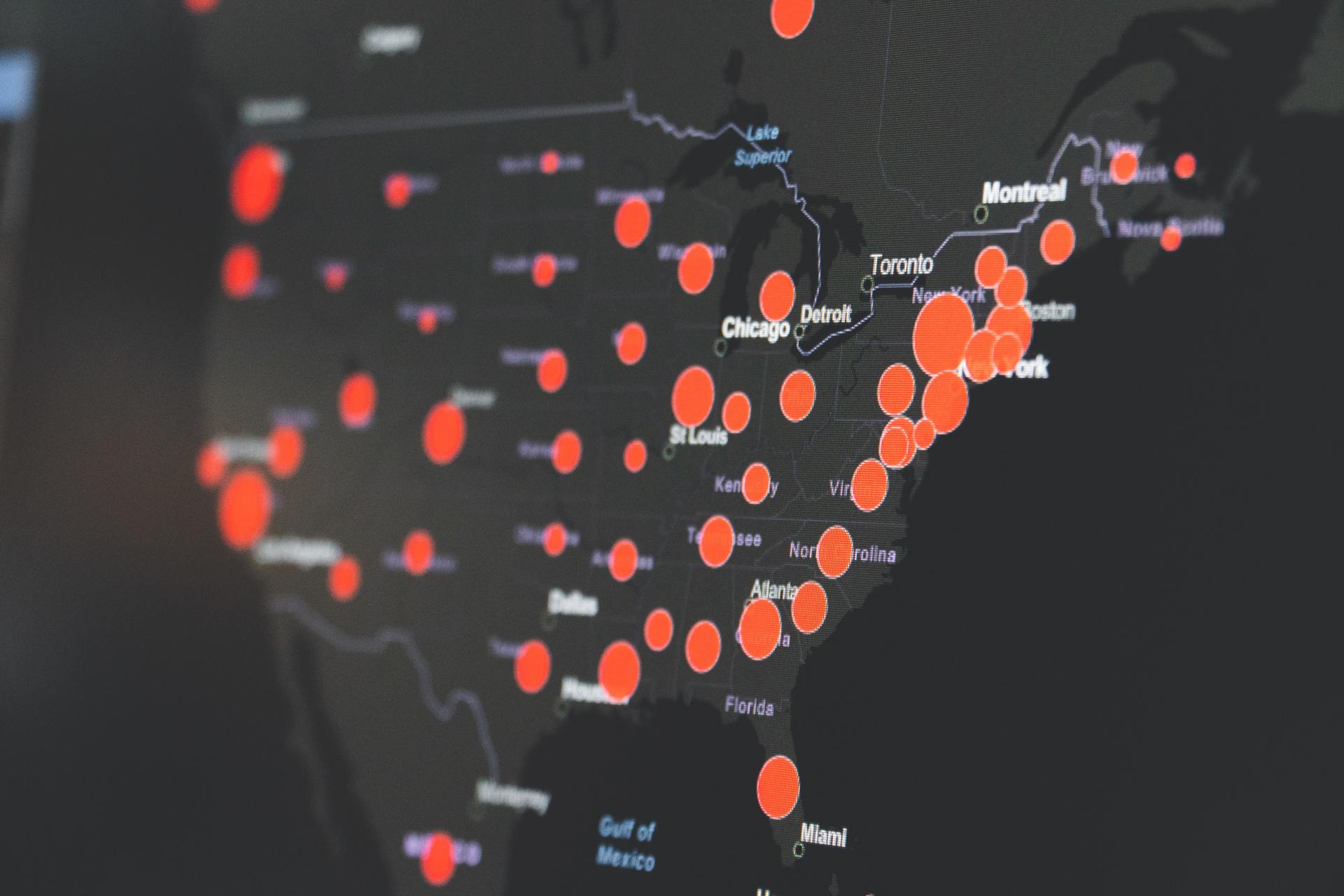

The current COVID – 19 has been classified as a Pandemic virus world wide

Living Benefits is a clear winner when purchasing your 1st Life Insurance policy The most obvious reason to buy life insurance is when you have clear insurable interest and have financial protection against a catastrophic accident or illness. For example, you may have large debt obligations from student loans, credit cards, and housing obligations you do not want to be passed on to someone else. You might also have a partner and/or child who relies on you for financial support. Family members could depend on the insurance claim to survive in the event something unfortunate was to happen to you.

A Life insurance policy with critical illness coverage provides a lump-sum payment to policyholders who survive one of the critical illnesses listed in the policy. 1 out of 3 Canadians will be diagnosed with some form of critical illness. Critical Illness is a defined disease or illness in a state in which death is possible or imminent. The initial sign you are experiencing a critical illness is when you get rushed to the hospital and admitted into an intensive care unit and placed on life support because of complications of a severe illness that manifests itself in one or more of the following conditions; 1. Heart attack 2. Stroke 3. Respiratory complications 4. Infectious disease such as a rash 5. pneumonia

Canada Education Savings Program (CESP) is an opportunity for parents in Canada to start saving for their child’s post-secondary education from the time the child is born until age 17. The Government of Canada has reported more than $63.0 billion in registered education saving funds at the end of 2019 with $5.0 billion contributed in that same year. Assess to post secondary education is a high priority for most Canadians with more than 7 million children are registered in the CESP where more than 53% of those children are currently receiving benefits to pay for their education.

Permanent life is preferable to term insurance by 2:1 high- net-worth Canadians taken in an Ipsos poll study in 2016 by Sun Life High-net-worth Canadians prefer permanent life insurance to term insurance-worth taken in an Ipsos poll study in 2016 by Sun Life 1. Why would a high-net-worth individual want to purchase life insurance? Response: high-net-worth (HNW) earners see Permanent life insurance as an investment; to guarantee a stream of tax-free income upon death to support their loved, ones who depend on the paternal income for continued financial support and to allow for generational transfer of continual capital growth of net worth without interruption to be managed as part of the overall family estate 2. Okay, but why Permanent and not Term? Response: Term insurance is preferable to permanent if purchased for a specified need and time, as with a 25 year amortization period mortgage; unless you die within that time frame, the insurance will end. Whereas you purchase Permanent insurance at a level premium for life, along with the cash value and dividends accumulation, you own the policy. The permanent policy only ends when the policy owner dies or surrenders the policy for its surrender cash value. 3. Weigh in on the pros and cons of paying a higher premium for Permanent insurance? Response: Advantages of Permanent Life option: a. Premiums are level b. You can pay premiums to allow the policy to be paid up over a set period c. Owning permanent life insurance; you generate tax-free earnings within the policy to cover unforeseen health concerns such as critical illness and long-term care d. Tax-free investment vehicle; choice of investment portfolio and earned dividends from participating life policy e. Ability to allow your whole life policy to be a spousal /dependent testamentary trust f. Under Canadian succession laws, a life policy bypasses rebate fees provided the policy did not list the estate as the beneficiary. g. Under Canadian law, you can set up an Insurance testamentary trust and have a Trustee manage the trust for a limited period on behalf of the dependents before disbursements. h. A permanent policy can provide for term riders geared to specific needs over a set period, then end. i. Ability to leverage the cash value within the policy for a personal loan Response: Disadvantage of Permanent Life: exercising an option to cash in on the surrender of the policy and allow it to lapse in doing so several factors will affect the early surrender value of the policy; a. How long the policy has been in force and the total amount of premiums paid to date b. The amount of interest, dividends, and capital gains that the cash value has earned in the policy c. The amount of cash surrender fees the insurance company will need to assess to liquidate the policy d. The portion of the cash surrender that is the actual premium paid is not taxable, but that portion of the surrender value classified as dividends, interest, and capital gain is taxable earnings. All the factors taken together by the surrender cash value of the policy will be less than the actual cash value if taken out too soon. It is best advised to exercise other options to avoid an early surrender of the policy, such as a policy loan already mentioned under the advantages.

There are 2 coverage components of your Travel Insurance Plan you need to read closely which will have a direct impact while travelling outside of your province prior to March 13, 2020 when the Canadian Government placed travel restrictions on Canadian looking to travel abroad. 1. Travel Insurance Plan: Medical emergency - in most policies all related expenses related to emergency medical costs as well as emergency evacuation if need be will be covered . Trip cancellation/interruption - if you planned a trip scheduled after March 14, 2020 and had to be cancel due to COVID-19 you will be refunded 100% and if you were aboard prior to March 14, 2020 and instructed by Canadian government to return, you can expect a prorated refund for early return. The other insurance policy has to to with income replacement Short Term Disability Plan a private income replacement plan and / or Employment Insurance (E I) which is mandatory coverage by the Canadian government paid as a payroll deduction by you if you are an employee. 2. Short Term Disability Plan: if you test positive and become ill with the COVID 19 you can receive as much as 75% of your weekly earnings to a maximum amount depending on the type of short term coverage listed in your policy. Payment will continue upon until you recover or a maximum period of 8 weeks if you are expected to remain in your home to recover you can expect the same benefits If you become critically ill and not able to return to work after 8 week period you may be eligible for Long Term disability (LTD) depending on the severity of your illness and the type LTD arrangement you have with your employer or self-employed a private plan. In all cases contact your employer and check your employee benefits package for details for your specific situation. If you are self-employed check your disability policy and/or contact your advisor. To make a Short-Term Disability Claim due to COVID – 19 pay close attention to this recent notice regarding claims to your employers

The beauty of searching online for insurance you are able to obtain a wealth of information from various sources without interruption and at your own pace. You can compare and seek out rates from different types of insurance coverage, Life, Disability, Critical Illness, Healthcare and Travel to name a few. You can determine why rates are different based on various factors such as health related issues, duration of policy, type of additional benefits know as additional riders. All these factors go into helping explain the difference in premium rates. You will further learn why rates are different based on the duration of a certain policy such as Term Vs Permanent and why Universal Life Policies based on investment and savings options will alter the premium rates based on your personal choice. Having information first hand why insurance policies differ can help you better appreciate why premium rates can vary not just the type of policy based factors such as gender, age and state of health plays a major role in determining rates as well. Now that you have a base knowledge about insurance in general and how rates can vary, you can now go online to look up coverage not just for yourself but for family members and close friend as well in assisting with their respective rates without guessing and doing false comparison based verbal hearsay. Having access to quoting helps you become a better informed buyer. There is one reservation that must not be overlooked when looking to purchase a policy online; premium quotes are actuarial calculations based on four primary factors: age, gender , duration, amount of coverage and the underlying health risk. In the case of a standard Online Quote does not take into account the underwriting analysis and the collaboration that takes place between the underwriter and advisor that is typically brought back to you prior to applying online could overt a possible risk of being rated or worst declined and creating complication in not being able to apply for the same type of policy insurance for at least 2 years including being red flagged with the Medical Insurance Bureau (MIB) of Canada. Recall back in a day long before all things internet came along, an insurance agent would come knocking on your door to see if you were interested in buying a Life Insurance Policy on the spot. By contract today consumers are well informed buyers able to investigate online and do some research on your own, reviewing various benefits including comparing premium rates from leading insurers before speaking with an insurance advisor. This truly is a beautiful and tremendous breakthough for the insurance industry and especially on the part of a more enabled conscientious buyer who takes a more need based approach in the case of purchasing a Life Insurance policy rather than being drawn into a sales driven approach based only on raw emotions.

No matter what business you’re in or how many people work for you, your employees are likely among your key assets. Your business probably wouldn’t be successful without them. And your business functions best when they are at their best. Through research carried out in 2014, Manulife has established that there is a strong relationship between personal financial wellness, physical and emotional health, and productivity. We are of the view that to keep employees engaged, and to keep productivity optimal, employees need to be physically and emotionally healthy, and they need to be financially well, too. In 2015 Manulife commissioned Environics Research Group to survey 2,004 individuals to gain a better understanding of Canadians’ financial wellness levels. The results were eye opening. The survey showed that while 28% of respondents felt they had a high level of financial wellness and just over one-quarter (27%) felt they had a medium level of financial wellness, almost half (45%) identified themselves as having a low level of financial wellness. This alarming statistic manifests itself in numerous ways, including a lack of retirement readiness, inadequate financial protection in case of unforeseen events and high levels of money-related stress. Digging deeper into the segment of respondents with a low level of financial wellness, nearly half (45%) of them felt distracted at work because of financial worries. Our previous researchi has identified that distracted employees, or employees who are not engaged in their work, have lower rates of productivity, which can negatively affect business’ bottom line. This leads us to believe that disengaged employees are also less attached to their organization and therefore more likely to be lured away by other employers, which increases a company’s costs for employee searches, hiring and training. Financial support and education, well beyond retirement education, could go a long way toward improving the financial wellness of your employees. That means helping employees holistically – from savings to debt to insurance. For some employers, the workplace can be an ideal spot to deliver the tools that allow employees to achieve improved financial wellness for themselves, thereby becoming more engaged in their work and boosting the bottom line of the organization they work for, too.

W hile discounted gym memberships, paid-for massages, or free orthotic shoes are what get most employees excited about their benefits packages, it is the heavyweight insurance-based benefits – life, LTD, critical illness, accident, etc. – that can save the day when catastrophe strikes. Brent Delveaux, benefits consultant for Vancouver-based TRG Group Benefits & Pensions Inc., agrees employees tend to be more interested in transactional benefits, or the day-to-day stuff, such as paramedical, vision, dental. But no matter how much money they make, people can usually afford physiotherapy or prescription glasses even without being fully covered under the plan, he says. “That’s not the case with some of the expensive drugs that are in the marketplace (for cancer, heart attack, stroke, etc.). All you need is one situation, and everyone in the company will understand how important that benefit was.” In light of that, Delveaux says advisors have a responsibility to ensure the employer understands how important the insurance-related benefits are. “If they are a small employer, they may not see claims very often. For that matter, they may never have a life, disability or CI claim. But we see the horror stories of people who don’t have proper insurance. We witness what a challenge it is to go on living their lives if they don’t have proper coverage. We make sure we share these stories (without naming names) with our clients.” Gary Kawaguchi, president of PRL Benefits Limited, also believes insurance-based benefits are much more critical than paramedical benefits. Employers, he says, need to think about catastrophic loss and provide catastrophic coverage (life, disability, CI, unlimited drugs, etc.) before anything else. Employers also need to determine, early on, their philosophy toward benefits. “Benefits are part of compensation. That means you have to anchor yourself relative to the industry you compete in, because you need to hire and retain employees in that field,” says Kawaguchi. “Once you’re well covered for catastrophic loss, you should try and provide ample choice and optimized flexibility for other benefits.”